Are you worried about the ITR deadline!

Don’t worry, the fastest way is right here. HA TAX is your partner in ensuring quick & accurate Income Tax Return filing!

What is exactly Income Tax?

Taxation has been part of Indian society for a long time. The famous Ashoka’s pillar, Manu Smriti, and even Kautilya’s Arthashastra (which is a book on, The art of governance and foreign policy) mentions that – “From the treasury comes the power of the government, and the earth, whose ornament is the treasury, is acquired by means of the treasury and army”

In simple terms, Income tax is collected to give citizens thousand of other facilities. To fill the treasure under British rule first income tax was levied in the year 1860 and since then Income Tax has in itself has become a huge umbrella.

In financial language, it is the direct tax levied by the central government under Income Tax Act 1961. Tax is collected from the salaried person, or income from house property, any capital gains, and other income.

What are the major Deductions?

As the name Income Tax comes into the minds of people, the feeling of losing money comes. So, to take care of this, the Government of India with the aim to inculcate as well as encourage savings and investment amongst taxpayers has provided various beneficial deductions. Among all 80C is the most known one as it reduces taxable income by making tax-saving investments. 80 C allows deductions in investments made in Public Provident Fund, Pension Schemes, Employee Provident Fund, Life Insurance premium, and other schemes.

Apart from 80 C, there are other deduction plans which are beneficial.

What is Income Tax Return?

Income Tax Return is the annual record of income earned and other tax liability paid during the applicable year. This record is submitted to the government tax authority in a pre-defined format. This whole process of income tax return filing is called an Income Tax Return.

As an individual, entrepreneur, small, medium, or large organization needs to be well aware of tax payouts. Since it involves a huge sum of money tax planning is the best way to tackle all types of income tax returns so that one can reduce tax liability.

What are the Tax Slabs

Just like every individual has different clothing fitting, similarly, according to the individual financial status, one is taxed. To make things the simpler government has defined Tax-slabs and rates which helps one in Income tax return preparation.

What are different ITR Forms

As a person is supposed to submit Income Tax, the Income-tax department has framed 7 types of forms according to individual income and tax slabs. The seven forms are called ITR-1, ITR-2, ITR-3, ITR-4, ITR-5, ITR-6, and ITR-7.

We provide services to Individuals, Firms, and Corporate Companies.

Income Tax for Individuals

Income Tax of Individuals is classified into three sections, which are

1. Individuals (age < 60 years) including residents and non-residents

2. Resident Senior citizens (between 60 to 80 years)

3. Resident Super senior citizens (age > 80 years)

To make the process less complicated Government of India has given the flexibility to choose between two sets of Income Tax regimes. As the old regime is already known by individuals, HA would like to light the new regime.

The major difference between the old and new Tax regimes is the tax slabs. The slab is basically different tax rates are prescribed for different ranges of income. Considering individuals as unique, different slabs is an indication of a progressive tax system and fair system of taxation. Our HA Tax experts are here to help you with complete detail.

Drain the Tax Filing stress

HA TAX understands that Income Tax Returns consume a lot of resources & time. Additionally, the chance of making an error can lead to a problematic situation. Making your whole Income Tax Returns filing journey simple & smooth, just join us. All your queries & doubts will be resolved in a pinch.

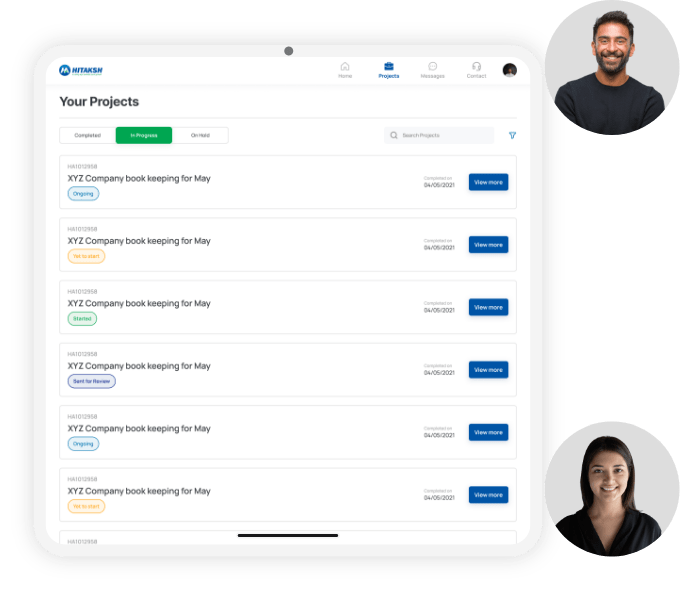

We know the best way to save taxes, that is, to get a maximum tax refund. With our online mobile and desktop portal, we are here to provide you with the easiest & quickest service which you might not have though-off yet.

We give our clients agility to put out their service needs, choose employees on their own, and fix deadlines for the task. Our clients can continuously monitor the work progress and in case of any doubt, they can connect to us at any time.

Some of the commonly asked Questions about Income Tax Filing.

Who need to file income tax return?

ITR according to Income Tax Law must be mandatorily filed if a resident individual’s total income during the financial year exceeds the basic exemption limit. Our virtual team will assist you in making you aware more about it.

How much tax I should pay?

Tax is levied according to the tax slabs in which one fits-in. For full taxation process our HA will help you.

What is the difference between FY and AY?

FY is the year where one earns income and AY is the year where one has to evaluate and file the Income Tax. AY is the succeeding year. So don’t worry about other related term which you come across because HA is here to help you solve with all the doubts.

Deductions like - 80c deduction, 80d deduction, 80ee deduction?

So has to encourage saving & investment among individual Income Tax Law chapter VIA of Deduction has introduced many beneficial deductions which are 80c, 80d, 80ee. To know more into depth our virtual employees will help you with it.

Form 16 preparation

It is technically TDS certificate. It is prepared by employer stating the employee deduction during a particular financial year. The other related form is Form 16A. So to more in detail about these form you can raise query with our HA anytime from anywhere.