Provident Fund Filing

Providing a one-step-ahead solution for your provident fund filing, a due date won’t be missed out

PF Return

Provident Fund registration one step forward is Provident fund filing. But many times a common query comes is that: How to file provident fund return?

Sideline all your worries and join HA TAX. With a proven history of guiding and managing Provident Fund filing, HA TAX ensures error-free results in Provident fund return filing.

Employee’s Provident Fund commonly known as EPF was implemented under the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 (PF Act) with an aim to make a forceful yet un-forceful saving for employees. Since the procedure for filing PF, returns is not easy along and monthly PF return filing is an add-on burden to the process.

But HA is making the process as simple as anything. Our clients need not think about

– When to file provident fund return?

– How to download EPF paid challan receipt?

– How to file epf nil returns?¯

Basic Filing Steps

The employer has to file PF return monthly before the 25th of every month. There are 4 types of forms that are -Form 2, Form 5, Form 10, and Form 12A.

The first and the foremost form is Form 2 which is filled by employees. It is a declaration & nomination form. This form is divided into two parts, Part A is general information about the employee and Part B is for individuals who qualify the eligibility criteria to receive the children/widow pension.

Form 5

It is a monthly report document containing details about the employee who have recently joined the PF scheme. It includes basic details about the employee which are filled and stamped by the employer. Form 2 and Form 5 should be submitted together.

Form 10

It is to be filed by the employer monthly providing the details of employees who have ceased to be part of the PF scheme. The main details are The date of leaving the service and the reason for leaving.

Form 12

It contains details about the monetary contributions made during a month

Along with the monthly contribution, annual PF filing is necessary for which the last date is 30th April every year. Form 3A and Form 6B along with other details such as Aggregate Contribution, Administrative charges, EDLI contribution, and a couple more.

HA TAX agrees with the statement by James M. Wayne

“The payment of taxes gives a right to protection”

Shake off the stress with HA TAX

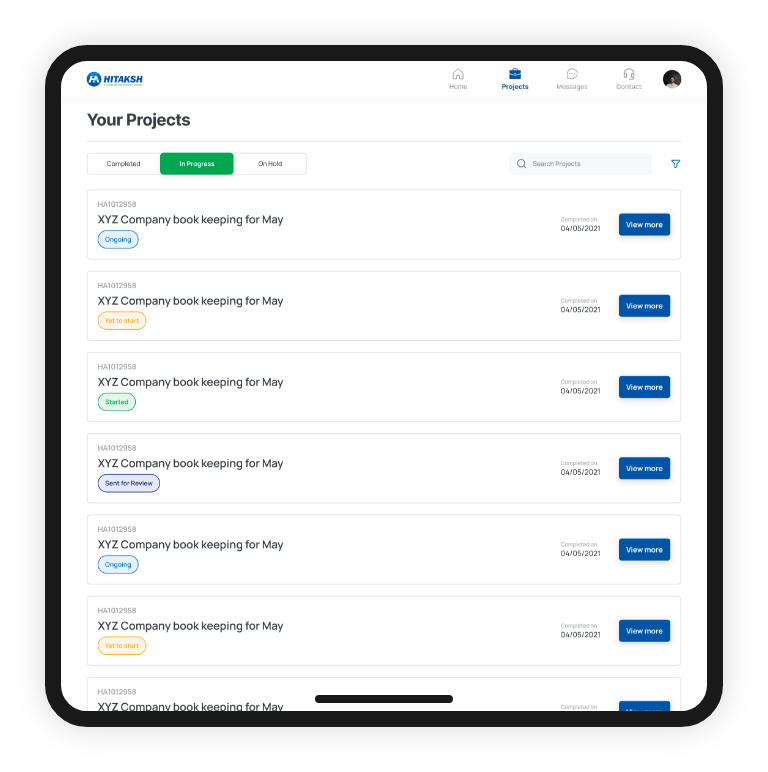

With our online HA TAX Professionals, we are making a smooth road for our clients in running their business processes.

With a perspective of providing a one-step-ahead solution, your provident fund return due date won’t be missed out and will be done earlier than that. As advantages of filing PF return filing are immense let’s get started soon.

Is PF Mandatory?

Yes, It is!

As the objective of PF is to provide financial stability & security to its employees. The advantages of PF are:

1. Provide welfare to the employee

2. Provide Social security

3. Medical Benefits

4. Taxation benefits

5. Compliance with the law

Since the Provident Fund is filed online all the documents are available online. One can download the document of his interest when required from the EPFO website.

PF Filing Procedure

Secondary, if the organization has no EPF members then EPF nil returns have to be filled.

1. One has to visit the website (www.epfindia.gov.in)

2. Click on ECR/Returns/Payment. This will lead to a new window where one has to put up the ID and password of the employer

3. In the next window, click on Payments then ECR Returns Filing

4. In the ECR Returns filing screen, under Direct Challan click on Challan Entry

5. Under Challan Entry, select the month and Administrative/ inspection charges challan

6. Fill Rs 75 in A/C No 2 under administrative charges and click on Next

7. These steps will successfully save the details. If any confusion over the form, then one can also edit otherwise click on Finalize

8. Finally one can pay & download the documents from the window