Goods and Services Tax

GST is one of the best implementations in the Indian taxation system. It sorts out many prevailing confusions with respect to the complicated indirect taxation system.

Simple Terms of GST

As well known, the Goods and Services Tax Act was passed in Indian Parliament on 29th March 2017 and was effective on 1st July 2017. As the introduction of GST was been criticized.

How it is calculated was a big question for people. But we here are making the whole process be explained in simple terms.

In a nutshell, it is an indirect tax on the supply of goods and services. It is famously known for being a comprehensive, multi-staged, and destination-based tax.

Under the GST umbrella comes Intra-State Supplies (SGST & CGST) and Inter-State Supplies (IGST). Here SGST stands for State goods and service tax and CGST stands for Central goods and service tax. To cater to the Union Territories, which don’t have legislature have UTGST.

This whole system is looked after by the GST council which is headed by the current Union Finance Minister and consists of representatives from the Centre and the States.

Advantages of GST

GST Registration Process

It is a PAN based registration process which is completely digitalised hence increasing transparency in tax collection. With government designed portal, any supplier (goods/ services) in India whose aggregate turnover is exceeding the desired limit has to get registered under GST. After successfully registration one get unique GSTIN number which is technically a pass that supplier is legally authorised. The whole registration process involves number of forms, that is, GST REG 1 to 10.

Although the process is very simple and easy, yet small businesses face hassle in full-filling it. So to cater small business owner needs, Composition Scheme is introduced. Opting for composition scheme is simple and beneficial to the business owners. Apart from this the business owners doesn’t need to be physically present in the GST office all the formalities like return filing, status verification and payment can be easily done online.

How HA TAX Helps You (Stress-free)

At HA we understand that running a business is a big deal in itself and managing other accounting & financial aspects consumes a lot of resources.

So, here we are with the finest team of tax experts catering to all your needs with respect to monthly returns filing making sure that you are far-far away from tax penalties and all invoicing rules are being catered well.

Since the GST rates have been categorized under different slab rates for different sizes of business & types of business are easy yet complicated for the ones who are new to the system, we are here to make things simpler.

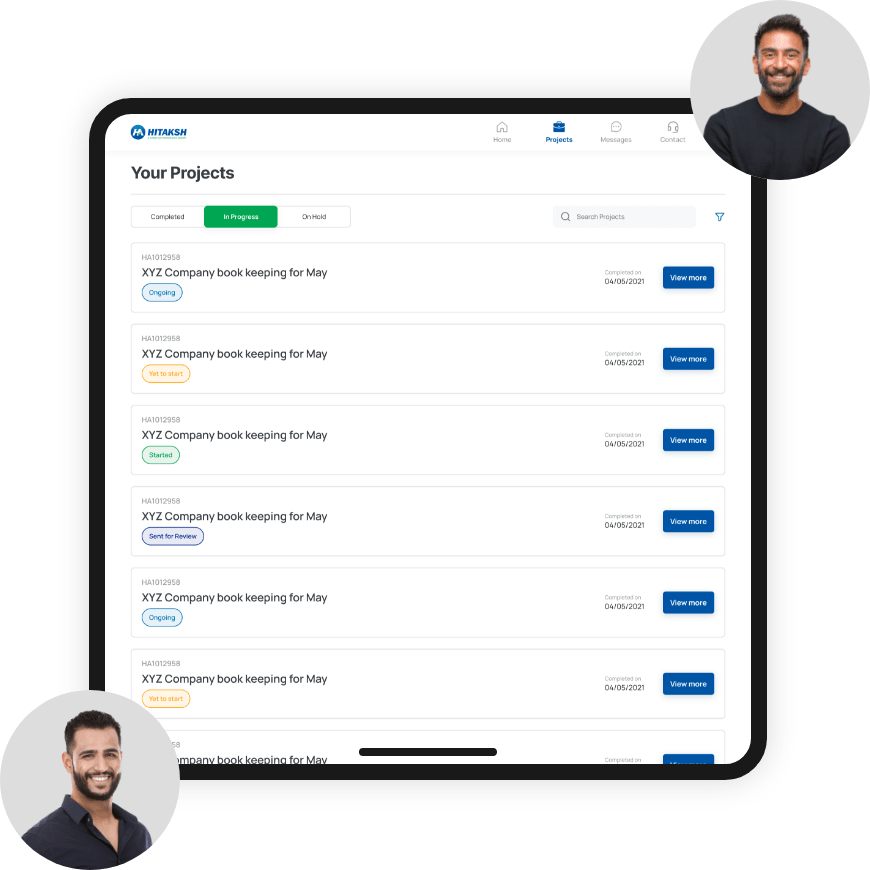

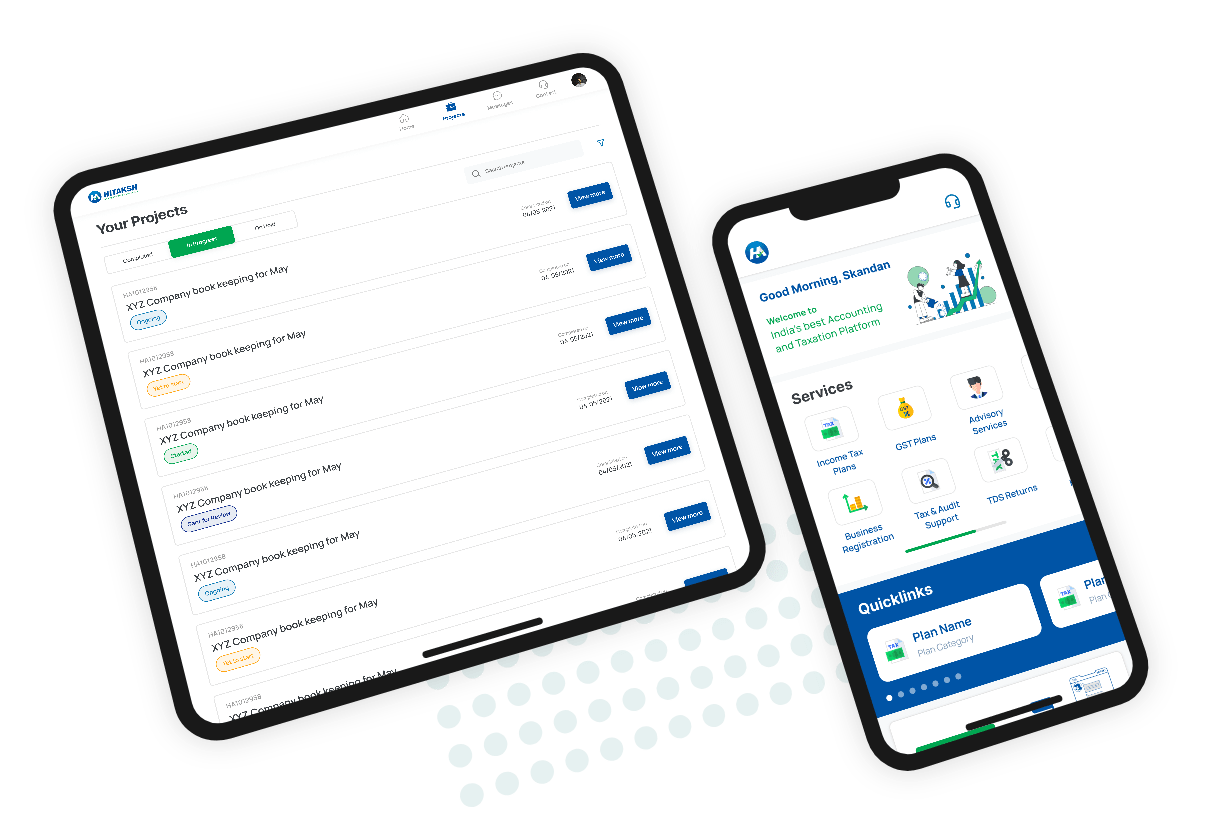

With our digital platform, once our clients sign-up they only need to put up their desired service request, select the plan of their need, set a deadline for the service and then relax and monitor the progress of work.

We believe to minimize the communication gap between our clients and us, henceforth our clients can anytime put up their query on our platform. With a chat-based app, we assure you that you can grab a cup of coffee and relax.

Ready to file a GST Return

We are here to serve all your GST needs, educate you as well, and help you to flourish your business.

Let’s Talk

Ready to File a GST Return?

We are here to serve all your GST needs, educate you as well, and help you to flourish your business.

Lets talk

Ready to File a GST Return?

We are here to serve all your GST needs, educate you as well, and help you to flourish your business.

Lets talk