Employee State Insurance Corporation

Choose HA TAX for worry-free processing of ESIC Registration. Our team of experts will take care of everything with maximum care.

What is ESIC?

Employee State Insurance Corporation (ESIC), an autonomous body created by the law under the Ministry of Labour and Employment, Government of India manages Employee State Insurance (ESI)

The ESI scheme was initiated for the benefit of the Indian workers. Under the Act, both the employer and employee make a contribution towards the ESI scheme, which will be used to provide the workers with a wide variety of medical, monetary and other support

Applicability of ESIC

Under Section 1(5) of the ESI Act, ESI is applicable for the following entities:

• Shops

• Restaurants or hotels engaged only in sales

• Cinemas

• Road motor transport establishments

• Newspaper establishments (which are not covered under the Factory Act)

• Private medical institutions

• educational institutions

It is mandatory for any factory or establishment having more than 10 or 20(in the case of some states) employees who have a maximum salary of Rs. 21,000/- to register itself with the ESIC within 15 days from the date of its applicability.

Under this scheme, both the employer and employee need to contribute an amount of 3.25% and 0.75% of the total monthly salary payable to the employee in the year. However, an employee whose salary is less than Rs.176/- per day doesn’t need to pay his contribution of ESI

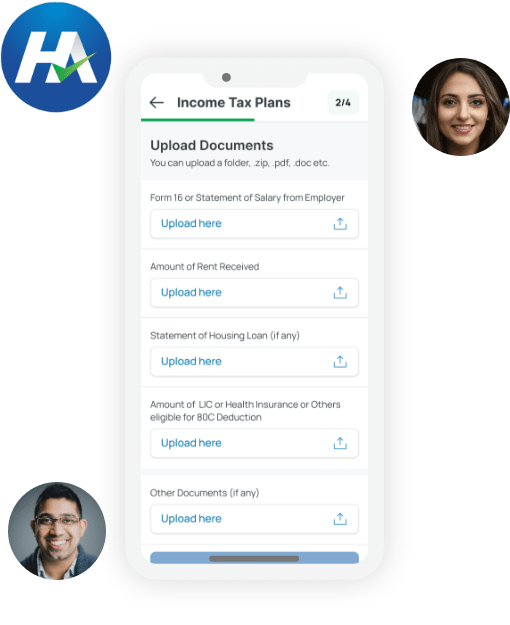

Documents Required for Online Registration of ESIC

To register for ESIC, the employer has to upload the following documents while submitting the application:

• Registration Certificate issued under Shops and Establishments/Factories Act

• Address Proof – latest electricity bill or rental agreement

• PAN card

• Aadhar card

• Copy of Bank Statement or Cancelled Cheque

• Memorandum and Articles of Association or Partnership Deed or Trust Deed

• A list of all the employees and the amount of salary paid to them

Process of Online Registration under ESIC:

Step-1: Sign Up on the ESIC Portal by clicking on the “Employer Login” button and filling in the required details.

Step-2: After submission, a Confirmation Mail will be sent by ESIC with User ID and Password for Login

Step-3: Login to ESIC Portal using the credentials and Complete the Registration form by clicking on New Employer Registration.

Step-4: After completion of the form, the employer will have to pay an amount of contribution for 6 months as an advance.

Step-5: On successful payment of the advance, the system generated Registration Letter will be sent to the Employer which contains a 17-digit Registration Number

Benefits of ESIC Registration

There is a wide range of benefits available to those registered under the scheme. Some are as follows:

• Sickness benefits @ 70% in case of certified illnesses and which lasts for more than 90 days in a year

• Medical benefits for employee and his family members

• Maternity benefits for pregnant women (paid leave)

• If any demise or disability of the employee takes place at the premise, 90% of the salary is given to the dependents of the employee in the form of the monthly payment

• Funeral expenses

• Old age medical care

• Confinement expenses

• Vocational or Physical Rehabilitation

Compliances after ESIC Registration

After registration of ESIC, every employer has to comply with the following:

• Maintaining an attendance register

• Keep a register of wages paid to workers

• Book of Inspection

• Monthly return and challan to be paid within 15 of the next month

• Maintain a register to record accidents that happened on the premises

Returns to be filed after ESIC Registration

After registration, the employers have to file ESI Returns every 6 months.

Documents required for filing the returns are as follows:

• Attendance register of employees

• Form 6 – Register

• Register of Wages

• Register of Accidents

• Monthly Returns and challans paid

Process

Process of Online Registration under ESIC:

Step-1: Sign Up on the ESIC Portal by clicking on the “Employer Login” button and filling in the required details.

Step-2: After submission, a Confirmation Mail will be sent by ESIC with User ID and Password for Login

Step-3: Login to ESIC Portal using the credentials and Complete the Registration form by clicking on New Employer Registration.

Step-4: After completion of the form, the employer will have to pay an amount of contribution for 6 months as an advance.

Step-5: On successful payment of the advance, the system generated Registration Letter will be sent to the Employer which contains a 17-digit Registration Number

Benefits

Benefits of ESIC Registration

There is a wide range of benefits available to those registered under the scheme. Some are as follows:

• Sickness benefits @ 70% in case of certified illnesses and which lasts for more than 90 days in a year

• Medical benefits for employee and his family members

• Maternity benefits for pregnant women (paid leave)

• If any demise or disability of the employee takes place at the premise, 90% of the salary is given to the dependents of the employee in the form of the monthly payment

• Funeral expenses

• Old age medical care

• Confinement expenses

• Vocational or Physical Rehabilitation

Compliances

Compliances after ESIC Registration

After registration of ESIC, every employer has to comply with the following:

• Maintaining an attendance register

• Maintaining a register of wages paid to workers

• Book of Inspection

• Monthly return and challan to be paid within 15 of the next month

• Maintain a register to record accidents that happened on the premises

Returns

Returns to be filed after ESIC Registration

After registration, the employers have to file ESI Returns every 6 months.

Documents required for filing the returns are as follows:

• Attendance register of employees

• Form 6 – Register

• Register of Wages

• Register of Accidents

• Monthly Returns and challans paid

Process

Process of Online Registration under ESIC:

Step-1: Sign Up on the ESIC Portal by clicking on the “Employer Login” button and filling in the required details.

Step-2: After submission, a Confirmation Mail will be sent by ESIC with User ID and Password for Login

Step-3: Login to ESIC Portal using the credentials and Complete the Registration form by clicking on New Employer Registration.

Step-4: After completion of the form, the employer will have to pay an amount of contribution for 6 months as an advance.

Step-5: On successful payment of the advance, the system generated Registration Letter will be sent to the Employer which contains a 17-digit Registration Number

Benefits

Benefits of ESIC Registration

There is a wide range of benefits available to those registered under the scheme. Some are as follows:

• Sickness benefits @ 70% in case of certified illnesses and which lasts for more than 90 days in a year

• Medical benefits for employee and his family members

• Maternity benefits for pregnant women (paid leave)

• If any demise or disability of the employee takes place at the premise, 90% of the salary is given to the dependents of the employee in the form of the monthly payment

• Funeral expenses

• Old age medical care

• Confinement expenses

• Vocational or Physical Rehabilitation

Compliances

Compliances after ESIC Registration

After registration of ESIC, every employer has to comply with the following:

• Maintaining an attendance register

• Maintaining a register of wages paid to workers

• Book of Inspection

• Monthly return and challan to be paid within 15 of the next month

• Maintain a register to record accidents that happened on the premises

Returns

Returns to be filed after ESIC Registration

After registration, the employers have to file ESI Returns every 6 months.

Documents required for filing the returns are as follows:

• Attendance register of employees

• Form 6 – Register

• Register of Wages

• Register of Accidents

• Monthly Returns and challans paid

Ready to Register your ESIC?

We at HA TAX promise you serve your ESIC needs without any stress. Connect with us to enjoy a seamless experience.

Let’s Talk

Ready to Register your ESIC?

We at HA TAX promise you serve your ESIC needs without any stress. Connect with us to enjoy a seamless experience.

Lets talk

Ready to Register your ESIC?

We at HA TAX promise you serve your ESIC needs without any stress. Connect with us to enjoy a seamless experience.

Lets talk