Powerful Expert Team to Back You Up

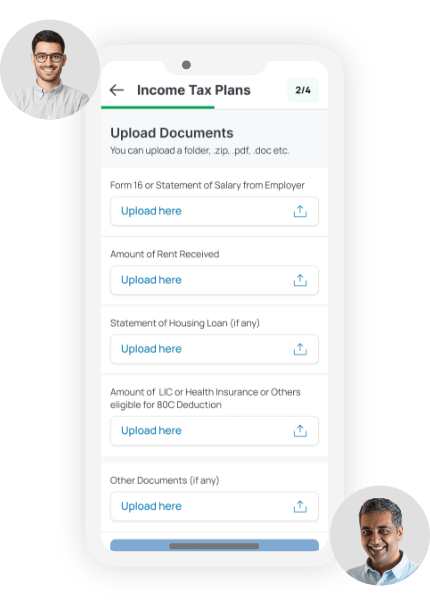

Drain the Accounting and Tax filing Stress

Modernize your Tax experience with HA TAX

How HA TAX helps in Accounting and Tax Filing for SME’s

Most entrepreneurs are not aware of the various government schemes and benefits available to their organizations when they are registered as SMEs.

At HA, we have a team of Chartered Accountants and a dedicated CA will be assigned to you who helps in

• Identification of the right type of registration applicable for you

• Registration of your business with the government

• Providing you advice on how to extract maximum benefits from government schemes

• Minimise your cost of accounting, taxation, and audit

Our dedicated Customer Relationship Manager at HA overlooks the process to have the services delivered to you perfectly without any errors or mistakes.

HA encourages a lot of energetic citizens to come into action and sow the seeds of their ideas because the time is right and with the right set of HA team one can get benefits just like the ‘cherry on the cake’

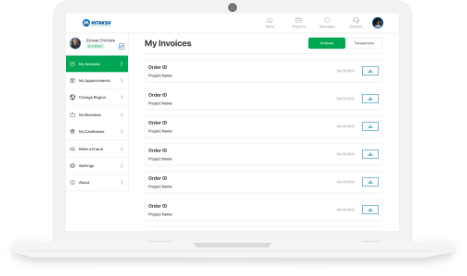

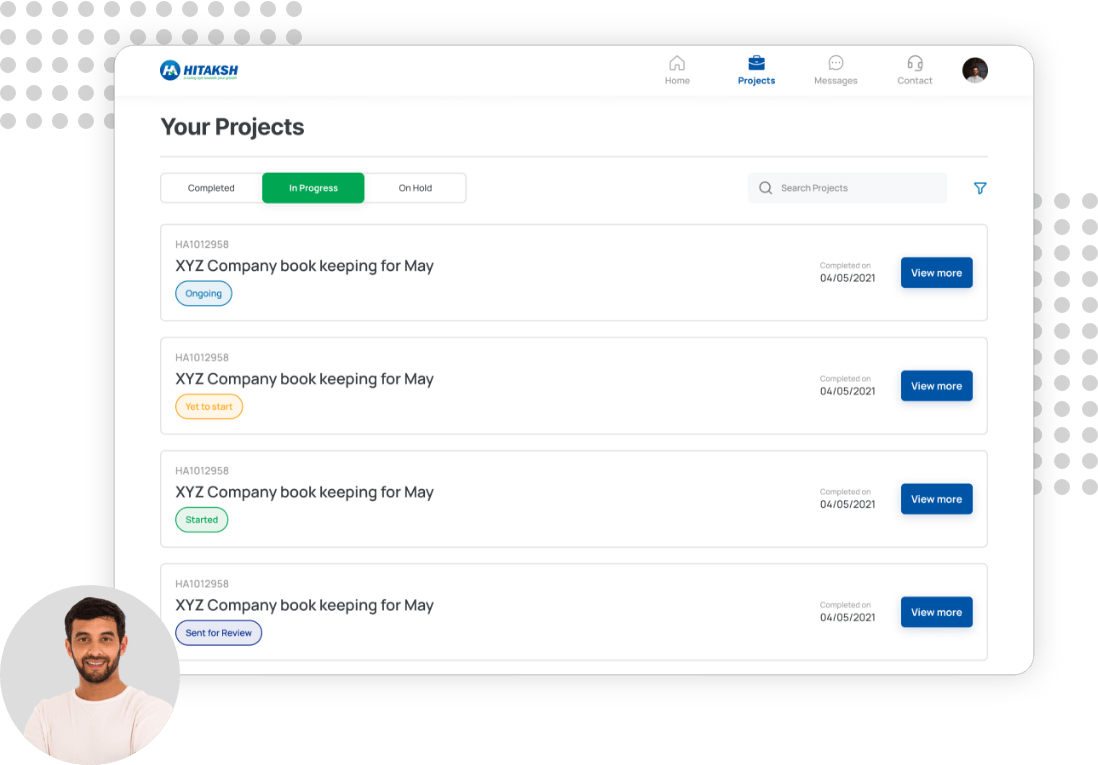

Technical Expertise of HA TAX

At HA we have adopted a lot of tech approach in solving the business aspects which lies in Accounting and Tax Filing for SMEs.

Some of the listed features are-

1. High-security system

2. Expert team

3. Agile process

4. Chat-based Mobile & Desktop application

5. 24/6 support service

To further know about our incredible team and our working process get connected to us soon

Overview of SME’s

Small and Medium Enterprises generally known as SMEs are businesses that are known to have a decent share in the development of the economy of any country.

These business establishments are recognized by United Nations as well because they are major contributing factors for developed nations too. But the definition of SME does differ from one country to another country. As per India, Micro, Small and Medium Enterprise Development (MSMED) Act 2006 has defined SME definition

Manufacturing or Production

Enterprises engaged in the manufacture or production, processing or preservation of goods as specified below:

A microenterprise is an enterprise where investment in plant and machinery does not exceed Rs. 25 lakh;

A small enterprise is an enterprise where the investment in plant and machinery is more than Rs. 25 lakh but does not exceed Rs. 5 crores;

A medium enterprise is an enterprise where the investment in plant and machinery is more than Rs.5 crore but does not exceed Rs.10 crore. In the case of the above enterprises, investment in plant and machinery is the original cost excluding land and building and the items specified by the Ministry of Small Scale Industries vide its notification No.S.O.1722(E) dated October 5, 2006

Enterprises engaged in providing or rendering of services

Enterprises engaged in providing or rendering services and whose investment in equipment (original cost excluding land and building and furniture, fittings, and other items not directly related to the service rendered or as may be notified under the MSMED Act, 2006 are specified below.

A micro enterprise is an enterprise where the investment in equipment does not exceed Rs. 10 lakhs;

A small enterprise is an enterprise where the investment in equipment is more than Rs.10 lakh but does not exceed Rs. 2 crores;

A medium enterprise is an enterprise where the investment in equipment is more than Rs. 2 crores but does not exceed Rs. 5 crores.”

Talking with respect to the Indian context, SME’s has made a significant contribution towards improving GDP and export.

This has positively contributed towards the growth in improving the socio-economic condition of the country. This sector has been a backbone of establishing entrepreneurship in semi-urban and rural India.

Micro Small Medium Enterprises (MSME)

MSME was introduced by the Indian Government in 2006 which is governed according to the MSME Act of 2006. As per the Act classification was based upon the two major categories:

1. Manufacturing

2. Service

But from 1st July 2020, these categories have been removed and the new classification is based on the basis of turnover limit and also investment made by the businesses in any fixed asset

Micro : Investment: <1 crore; Turnover: Up to 5 crores

Small : Investment: <10 crores; Turnover: up to 50 crores

Medium : Investment: <50 crores; Turnover: up to 250 crores

Role of SME’s & it’s Technology in Indian Economy

Around 80 million Indian citizens are working in SMEs, which technically comprise about 40% of the total workforce. This gives an incredible opportunity for individuals who are low-skilled in creating a decent livelihood. Around 45% (1.3 million) SMEs are from Manufacturing Sector and 40% from Export Sector creating a backbone for the Indian Economy.

As every coin has two sides, similar in the case of SME’s there are many economic problems that this sector faces despite employing 40% of the workforce. The sad part is although employment is so high the GDP contribution is only about 17%.

Innovative culture and technology aspects such as accessibility to the internet, skilled labor, and resources have always been talked points. With time, the scenario is changing and a highly innovative growth mindset is observed.

According to the study by Oxford Economics 60% (approx. 2300) of executives agreed to adopt an innovative work approach and make it they are top-priority in daily work.

Technology is such a powerful element that can be implemented in every corner of the industry. It has the ability to improve, innovate, strengthen the customer relationship and give a favorable environment to land in newmarket

Government’s Role in Promoting SMEs

Various initiatives by the Government of India have been fuel in boosting the performance of SME’s in India. This has clearly showed improvement in GDP numbers. Allocation of 20000 Crores to MSME through Micro Units Development Refinance Agency Bank (commonly called as MUDRA).

SME’s requirements is deemed to be fulfilled with respect to financial, investment, operational and technology development.

By observing the performance by SME’s in India the growth of SME’s seems to exceed at a higher rate than its competitor, that is, China. However, SME’s in India should focus over the quality of their product and service which will benefit consumers in long-run.

Implementing Idea into function is a lot simpler than earlier. A room and recognition for accelerators, incubators, investors and mentors are created now. With the emergence of Internet market and its usage the growth is further propelled which has brought a drastic change in the overall growth (both economic and non-economic) terms

Some of the Famous Schemes which are Introduced & Implemented for SME’s

Credit Guarantee Fund Scheme

This scheme provides collateral-free credit to Indian SMEs. A working capital loan is Rs. 100 Lakh per borrowing unit is facilitated by the ministry and SIDBI.

Credit Linked Subsidy Scheme for Technology Upgradation (CLCSS)

An upfront capital subsidy which is maximum up to Rs. 15 Lakhs is provided by the Ministry of Small Scale Industries (MSSI) to small scale industries which are to use for plant and machinery modernization

Financial Assistance on International Participation

This scheme has provided a platform for SMEs to participate in international trade fairs and other exhibitions. A reimbursement of 75% (on-time registration fee) and 75% (on recurring annual fee) which is paid by SME’s to GSI for the first 3 years for barcode is offered.

Other provisions such as foreign collaborations, joint-venture creation, and desired up-gradation is also facilitated

Technology & Quality Upgradation Support to SMEs

This scheme is introduced to provide benefits from energy-efficient technologies and manufacturing processes to reduce the carbon footprint. An SME can avail up to 75% of the cost expenditure is taken care from this scheme too

Mini Tools Room & Training Center Scheme

Financial aid maximum of 9 crores is provided by the Government under this scheme which covers the cost of machinery and other needed equipment.

75% of the cost of an existing room has to be upgraded.

The aim of this scheme is to create an environment for a skilled workforce that facilitates growth for the future too

Ready to Start your Business with HA TAX?

Now, you don’t need to worry about Due dates and Compliances. Your dedicated HA TAX Experts make you stress-free by taking care of Accounting and Tax Filing for SMEs.

We welcome you onboard soon.

Let’s Talk

Ready to Start your Business with HA TAX?

Now, you don’t need to worry about Due dates and Compliances. Your dedicated HA TAX Experts make you stress-free by taking care of Accounting and Tax Filing for SMEs.

We welcome you onboard soon.

Lets talk

Ready to Start your Business with HA TAX?

Now, you don’t need to worry about Due dates and Compliances. Your dedicated HA TAX Experts make you stress-free by taking care of Accounting and Tax Filing for SMEs.

We welcome you onboard soon.

Lets talk